MARKET RECAP

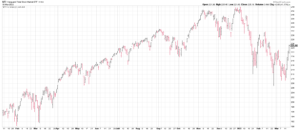

- Stocks had a sharp rally at the US market was up by 6.22% and international equities were up by 6.67%, the best gain since November of 2020. Oil dropped by 3%, bonds were down by 0.29%.

- With this weeks rally, stocks put in a higher low and a higher high, too early to tell if this is the end of this correction, but it has to start with a series of higher lows and higher highs.

- The Fed raised its fed-funds target rate by 1/4% to 0.25%-0.50%.It is the first of probably 6-7 rate increases this year, but the general consensus is the Fed is way, way behind the curve. David Rosenberg, or Rosenberg Research, says that tightening cycles have led to a recession 75% of the time, “The Fed has never tightened into such a maelstrom before – a shooting war, a pandemic, a weak and wobbly stock market, and an incredibly flat yield.” Talk about having your hands full!

- The 10/2 spread is just 20 basis points. An inverted 10/2 curve has signaled a future recession every time since the 1960s. But the 10-year/3-month curve, which economists also closely follow, still has a 1.7% point differential.

SCOREBOARD