MARKET RECAPS

US stocks were up by 1.02% and international stocks by 1.23%. As the market continues marching higher, signs of excessive optimism are all around. A recent Bank of America survey of professional money managers are underweight cash for the first time since May of 2013, holding only 4%. Individual investors are piling into speculative stocks with outsized best on call options. Bitcoin has broken out to new highs, now over $20,000. Value Line, a long-time investment research firm, calculates an 18-month target price range for the companies that it follows, the projection for the average stock is now 4%, the lowest number ever. At one point this year, when stocks were at their low, it was 72%. Speculation is running high in the IPO market. In this week’s Barron’s 2021 Outlook article, experts say stocks will gain 10% next year. More government stimulus and a faster-growing economy will provide the fuel for higher equity prices. The consensus is for the fastest economic growth in the US since 1984, +5%, and S&P earnings of about $170.

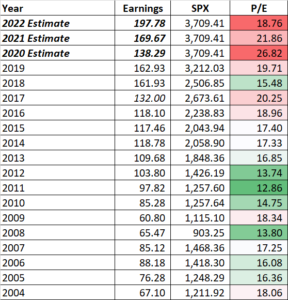

At a news conference this week, Fed Chair Jerome Powell did say that price/earnings ratios were on the high side but said that the equity risk premium was reasonable given low Treasury yields. Right now, the forward p/e based on 2021 earnings would be the highest p/e ratio since at least 2004 (see below). The problem is what happens when yields begin to rise. That may be a long way off, or maybe not, if the vaccine puts an end to the crisis and consumer spending explodes, setting off inflation, forcing rates higher, which would require a reset to lower p/e ratios.

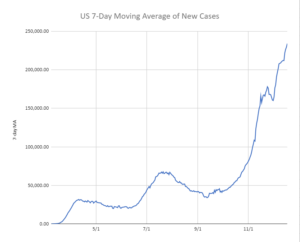

Growth on the virus stalled out for a couple of weeks pre-Thanksgiving, but as the experts predicted, the holiday put in motion another huge surge in cases. The Pfizer vaccine began its initial rollout this week, and the Moderna vaccine was approved on Friday. So, as the vaccines slowly rollout, the economy is getting closer to a return to something close to normal.

The surging virus is cutting into economic activity. Retail sales were down by a seasonally adjusted 1.1% in November from October, and October was revised down from +0.3% to -0.1%. Restaurants, department stores, and car dealerships were all down while groceries and building materials were higher. First-time unemployment claims were 885,000 last week, the highest level since September.

The electoral college declared Joe Biden the next president of the United States. Trump’s lawsuits challenging the election were all dismal failures. Congress still has not agreed on a relief plan, the two sticking points are aid to state and local governments, and business liability protection.

A recent ruling in a US District Court is sending shivers through the leveraged buyout industry. Judge Jed S. Rakoff ruled that creditors of retailer Nine West can file a lawsuit for $2 billion in damages against the company’s board of directors. The ruling stated that the board acted “recklessly by failing to adequately assess an LBO-buyers post-transaction solvency.” Brian Quinn, a corporate law professor at Boston College says “It could be a game stopper for the private equity business.” Basically, the Board sold off important Nine West brands leaving the remaining entity as a much weaker unit, with too much debt, which led to bankruptcy. Because of that, they are now liable. The ruling can be overturned on appeal, but for now, this can impact private equity going forward.

SCOREBOARD