HIGHLIGHTS

- US stocks managed a small advance, but international equities fell.

- Worries about the global economy and trade talks hurt the market.

- Growth forecasts in Europe and the UK are revised down.

- Jinping and Trump won’t meet this month.

- Stocks cannot break through the 200-day moving average.

MARKET RECAP

A rally in the final 10-minutes of the Friday session helped the US markets eke out 0.17% gain for the week. Stocks were up on Monday and Tuesday, flat on Wednesday and weak on Thursday and Friday on worries about the global economy and trade talks between the US and China. International stocks fell by 1.18%.

On Thursday, the European Commission lowered its growth forecasts for Germany, Italy, and the Netherlands. Overall, the European Union GDP is now forecast to grow by 1.5% in 2019, down from 1.9% in the prior forecast. The Bank of England cut growth forecasts to 1.2% for 2019, down from 1.7%, and warned that a no-deal Brexit could cause a recession.

Markets were also disappointed when Trump said he would not be meeting with Chinese President Xi Jinping until March. A meeting between the two would signal that an agreement was close at hand. White House economic adviser Larry Kudlow said that an agreement between the two countries is still “far away.”

From a technical perspective, the market appears to have lost near-term momentum. The S&P 500 closed just under the 200-day moving average on Monday and Tuesday but failed to crack it, falling back on Wednesday, Thursday and Friday. Another negative sign for stocks was the out-performance this week by the defensive groups like utilities and REITs as interest rates fell.

ECONOMY

While the US did have a positive bounce last month in the purchasing manager’s index, the trend around the world continues to be down. China is already in contractionary territory and the rest of the world is not far behind.

The ISM Non-Manufacturing Index in the US also declined in January, although the absolute number was still strong. The index declined to 56.7 from 58. New export orders took the biggest hit, dropping to 50.5 from 59.5, more proof of a slowing global economy.

Given the continuing decline in economies around the world, it will become more difficult for recent growth in the US to continue.

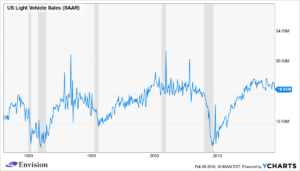

A possible early sign of a slowing US economy is light vehicle sales, which fell by 5.1% in January to an annual rate of 16.6 million, the lowest level since August of 2017. Severe weather in the Midwest is getting some of the blame. Year over year, there was a 3% decline.

Jobless claims fell last week to 234,000, down from the big increase the previous week to 253,000.

SCOREBOARD

Past performance does not guarantee future results.

The purpose of this commentary is to provide readers with a summary of recent market and economic news. It is not intended to provide trading advice. Investors should have a long-term plan and should consider working with a professional investment advisor. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The information and opinions contained in this material are derived from sources believed to be reliable, but they are not necessarily all inclusive and are not guaranteed as to accuracy. Any forecasts may not prove to be correct. Economic predictions are based on estimates and are subject to change. Reliance upon information in this material is at the sole discretion of the reader.