HIGHLIGHTS

- Another up and down week but stocks end in the black on a powerful labor report.

- Chinese PMI falls below 50.

- US PMI for manufacturing has a big drop to 54.1.

- A very strong payroll report in the US as nonfarm payrolls increased by 312,000.

- Economic growth in Q4 should be about 2.5%.

MARKET RECAP

2018 closed out on Monday with a 1% advance on news that the US and China were talking trade. When markets reopened on Wednesday after the New Year, a dreadful Chinese PMI report had the market fall by 1.5% on the open. But the market staged a strong comeback and closed just above the Monday close fueled by an oil price rally. Having somehow managed to withstand the poor PMI report from China, stocks took another punch on Thursday when Apple preannounced that sales had fallen sharply in Q4, by about $6 billion. That was followed by a US ISM Manufacturing report that showed the PMI at 54.1%, down from 59.3% in November, the market fell sharply by 2.31%.

The news going into the release of the Friday unemployment report was downright depressing, as it appeared the economy was beginning to accelerate much faster to the downside than anticipated. That is when economists were surprised with a much stronger than anticipated employment report. Investors loved the news as it put the threat of a recession on hold, at least for one day, and stocks rallied by 3.31%. For the week, US stocks were up by 1.95% and international markets were up by 2.14%

Looking back at the year 2018, the US was down by 5.21% and international markets fell by 14.43%.

PAYROLL

Nonfarm payrolls jumped by 312,000 in December, blowing out the consensus number of 176,000. It was the biggest increase since February. Even better, the prior two months were revised up by 58,000. The average workweek increased by 0.1 hours to 34.5 hours and average hourly earnings were up by 3.2% year over year. The unemployment rate did go up to 3.9% from 3.7%, but that was because more people were attracted to enter the labor market.

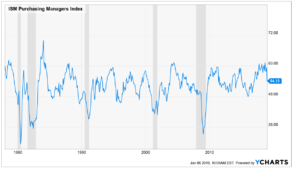

Institute for Supply Management PMI

The PMI for the US for the manufacturing sector fell to 54.1% in December from 59.3% in November. That is a large drop and was well below the consensus of 58%. The report indicates that while manufacturing is still growing, the pace of the increase slowed in December. A reading above 50 is considered expansionary.

CHINA

The trading year got off to a bad start on Tuesday morning when the China Caixin manufacturing purchasing managers index fell to 49.7 in December. It was the first drop below 50 since May 2017. A reading below 50 is considered contractionary.

ECONOMY

Q4 growth is estimated to come in around 2.5% or so. The Atlanta Fed GDPNow model has growth at 2.7% and the NY Fed NowCast model is projecting 2.48%.

SCOREBOARD

Past performance does not guarantee future results.

The purpose of this commentary is to provide readers with a summary of recent market and economic news. It is not intended to provide trading advice. Investors should have a long-term plan and should consider working with a professional investment advisor. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. The information and opinions contained in this material are derived from sources believed to be reliable, but they are not necessarily all inclusive and are not guaranteed as to accuracy. Any forecasts may not prove to be correct. Economic predictions are based on estimates and are subject to change. Reliance upon information in this material is at the sole discretion of the reader.