MARKET RECAP

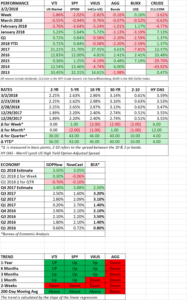

President Trump announced he would impose steep tariffs on steel and aluminum producers worldwide, setting off fears of a trade war. That, coupled with new Fed Chair Jay Powell’s testimony that the economy might be strong enough for four rate hikes this year, instead of the expected three, turned the markets down. US equities declined by 2.02% and international stocks dropped by 2.82%. US equities are now up by a mere 0.72% year-to-date and international equities are in the red by 0.58%.

With markets turning back down, the Bulls hopes of a quick “V” turnaround pattern in stocks is off the table. Now is the time to watch if stocks can hold their lows of a few weeks back.

STEEL TARIFFS

Trump entered dangerous territory announcing punitive tariffs on steelmakers worldwide. Not just countries that are supposedly “dumping” steel, but legitimate steel producers around the globe. History has shown that tariffs have, at times, led to unintended consequences, causing great economic damage to all countries. The threat is Trump just laid the opening shot in what could become a worldwide trade war. If Trump was intent on stopping unfair trade practices in the steel market, he could have targeted specific countries in that regard. Trump is invoking Section 232 of the Trade Expansion Act of 1962, which is a national security act that is supposed to be used only under extreme circumstances when there is a national security threat. That is not the case today. The World Trade Organization (WTO) allows such tariffs in the face of a legitimate national security threat. With Trump’s action, the bar has just been lowered and could easily invite retaliation from other countries impacting many different types of industries.

Adam Posen, president of the Peterson Institution for International Economics, said: “this is fundamentally incompetent, corrupt and misguided.” Steve Liesman, an economist at CNBC, remarked “I am hearing three words, technical terms from economists, bad, stupid, and dangerous. This is seen as one of the worst possible policies that any President could ever enact.”

The reaction to the President’s announcement on Thursday was not good. Steel stocks rose in market value by $2.3 billion but the S&P 500 dropped by $328 billion (see below).

ECONOMY

The February ISM report for manufacturing came in at 60.8. It was the strongest reading since May of 2004. The manufacturing sector is red hot right now. However, reports of new orders declined for the second straight month, a signal that the ISM could be topping out. Initial jobless claims were 221,000. An extremely low number indicating that the job market is still very strong.

The revised estimate for Q4 2017 growth came in at 2.50%, down from 2.60%. Current estimates for the current quarter are still in the 3%+ range according to the Atlanta Fed’s GDPNow and the NY Fed’s NowCast.

POWELL TESTIFIES

New Fed Chair Jerome Powell made his initial testimony on Tuesday in front of the House Financial Services Committee. Powell was optimistic about the economy, explaining we are in a “moment of global growth”. Due to a tightening labor market, he expects wage increases to pick up. He is not that concerned about recent volatility in the equity markets and stated that the Fed will continue with gradual increases in interest rates and a decrease in the Fed’s balance sheet. Powell did not comment on the increasing Federal deficit.

SCOREBOARD