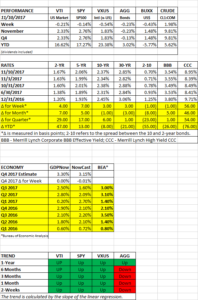

PERFORMANCE

US equities fell by 0.21%. It was the first weekly decline since September 10. Investors were worried about the prospects for tax reform. International equities dropped by 0.54%, the dollar declined by 0.43% and oil continued its rally, +1.98%.

The close on Friday made it official, the S&P 500 set the record for the longest streak ever without a 3% correction. Click here for a link to our article on how the market performs after extended streaks without a correction.

Another streak in progress is days without a decline of 0.5% or more. It has now been 47 days, the longest streak since 1965.

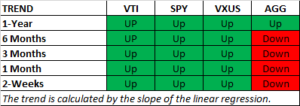

Bonds were down by 0.23% as interest rates increased slightly. The trend, as measured by the linear regression, for the bond aggregate is now negative in all the different time frames that we follow, except for one-year, as shown below.

DIVERGENCE BETWEEN HIGH YIELD AND THE S&P 500

Since late October the S&P 500 has been going in one direction (up) and the high-yield bonds have been going in another (down). Normally the two asset classes generally move together. When they diverge, it sometimes foreshadows direction. High-yield is often the leading indicator. A lot of the decline in high-yield is traced to the sell-off of a small group of widely held bonds. Sprint and T-Mobile ended their merger talks, and Teva Pharmaceutical’s and CenturyLink had poor earnings.

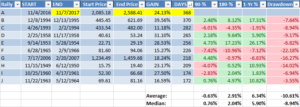

SCOREBOARD