HIGHLIGHTS

- Equities hit another high.

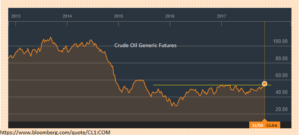

- Oil futures break out to a two-year high.

- Jerome Powell nominated as the new Fed chair.

- Another strong employment report.

- Republican’s release their tax plan.

PERFORMANCE

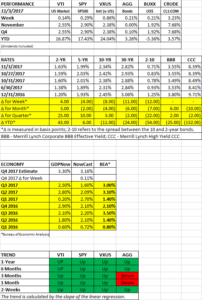

The market finished the week at another high. US equities were up by 0.14%, international equities increased by 0.86%. The dollar advanced by 0.21%. Bonds were up by 0.21% as the spread between the 10 and the 2-year note dropped by 12 basis points to 0.71%. That is down from 0.93% on September 30th and from 1.25% on December 31.

Oil broke out to a new year two year high, as crude oil futures were up by 3.23%.

NEW FED CHAIR

President Trump nominated Jerome Powell to succeed Janet Yellen as the new Federal Reserve Chair. With Powell, Trump gets a consensus-driven leader that will likely stick to Yellen’s laid out plan of gradual interest-rate hikes and the unwinding of the balance sheet. But Powell is more in tune with the Republican deregulation agenda.

Powell will become the 15th chair in the 103-year history of the Fed. According to Ned Davis Research, the average gain during the first six months after a new Fed chair for the Dow is 2.1%, with a median drawdown of 10.5%.

The Fed is expected to raise interest rates in December.

EMPLOYMENT

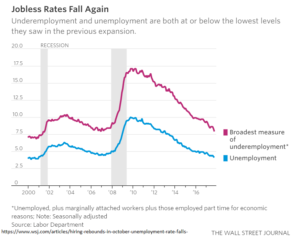

Nonfarm payroll increased by 261,000. Average hourly earnings stayed the same month over month and are up 2.4% year over year. The unemployment rate dropped to 4.1%, a 17-year low. But the drop was primarily due to the decline in the labor force participation rate to 62.7% from 63.1%. Hiring in September was revised to a positive 18,000 from an original estimate of -33,000. The tight labor market has some economists now projecting four interest-rate increases in 2017, instead of three.

PROPOSED TAX PLAN

The House made public their proposed tax plan, titled the “Tax Cut and Jobs Act”, with the primary aim of helping businesses. For individuals, while there will be mainly winners, some will end up paying more in taxes. It is likely the plan won’t survive in its current form, and it may end up not being passed at all, like past Trump initiatives. The bill is designed to only cost the treasury $1.5 trillion over the next ten years. Here are the highlights:

- The top rate for corporations drops to 20% from 35%.

- For corporations, net interest deductibility is limited to 30% of earnings before interest, taxes, depreciation, and amortization (EBITDA).

- Repatriation of cash from overseas would be taxed at a one-time rate of 12% and 5% for non-cash.

- The tax rate on pass-through entities, mostly small businesses, such as sole-proprietorships, partnerships, and Sub-S corporations falls to 25%. Now such entities are taxed at the individual income tax rates, as high as 39.6%.

- The top-rate for individuals remains at 39.6% but would start at $500,000 instead of the current $418,000.

- The six remaining brackets now become three: 35%, 25%, and 12%.

- The alternative minimum tax is eliminated.

- The estate tax exemption becomes $11.2 million per person instead of $5.49 million.

- The standard deduction is doubled.

- The deduction for state and local income taxes is eliminated.

- The property-tax deduction is capped at $10,000.

- Only homes up to $620,000 would qualify for full interest deductibility assuming the buyer puts at least 20% down.

- Private-purpose bonds would no longer be tax-exempt. These are the kinds of bonds often used for sports stadiums.

SCOREBOARD