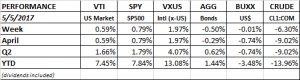

PERFORMANCE

The SP500 hit an all-time closing high on Friday, finishing at 2399.29. The index is now pushing up against its all-time intra-day high of 2400.98.

Overall US equities were up by about 0.60%. International equities continued to outpace US equities, +1.97%. Bonds fell as interest rates increased, the dollar was flat, and oil tumbled by over 6%. Volatility is ridiculously low, the VIX is at 10.97, close to a 10-year low. But investors are not overly optimistic. The AAII bullish sentiment is at 38.1%, less than the historical average of 38.5%. On the other hand, investors are also not pessimistic, the survey shows that bearish sentiment, expectations that prices will fall over the next six months, fell to 29.9%. The lowest reading since February 8.

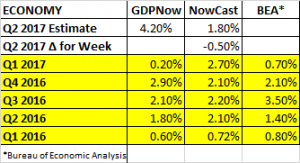

GDP

The Atlanta Fed’s GDP model came out with their first estimate for Q2 growth on May 1 with a sizable increase over a weak Q1, projecting growth at 4.3%. That was revised down to 4.2% later in the week on light vehicle sales. The NY Fed’s Nowcast projects Q2 growth at 1.8%, down from 0.50% from last week on a weak ISM manufacturing report.

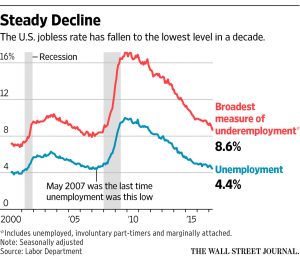

JOBS

The unemployment rate fell to 4.4%, its lowest level since May of 2007. Non-farm payrolls increased by 211,000, a big improvement over the 79,000 increase in March. The hiring increase was broad-based but hospitality led the way adding 55,000 new jobs, 37,000 jobs were added in healthcare. Even retail managed to hire 6,000 new employees. The labor force participation rate remained low, at 62.9%, consistent with the past few years and just above a four-decade low. Average hourly earnings increased by 2.5% year over year, narrowly outpacing the 2.4% increase in the consumer price index.

FED

The Fed kept interest rates steady at their meeting this week. The Committee said that the slowdown in growth in Q1 “as likely transitory.” That means, at least for now, the Fed still considers itself on track for two more rate increase this year. There is a good possibility the Fed will raise rates in June.

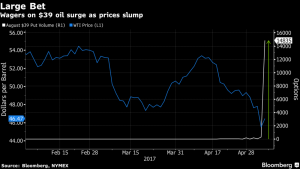

OIL

We said at our quarterly webinar that one risk to the market would be a collapse in oil prices. That was a contributing factor that led to the big market selloff at the beginning of 2016. Oil is down to about $46 per barrel from just north of $50 only a few weeks ago. Worries about weakening Chinese demand has hurt the pricing on all commodities. Options traders are starting to bet on fall below $40. The big spike in trades could be a sign of a peak in fear, and a contrarian would say this would be the time to get long for a recovery. But if oil continues to fall, especially if is breaks $40 to the downside, it might drag the market with it.

MANUFACTURING

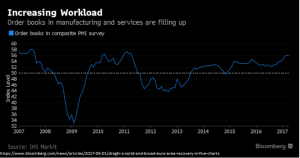

In the US, the ISM Manufacturing Index fell by 2.4 points to 54.8, the biggest drop since August. The decline indicates a small slow-down in manufacturing activity, but still up from last year.

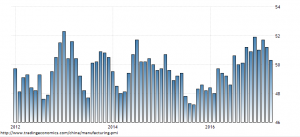

The Chinese Caixin Manufacturing PMI fell to 50.3 from 51.2. The reading was the weakest since September of 2016, although a reading above 50 still indicates expansion, although very slight. New export orders fell, there was weakening business confidence and employment fell the most since January.

PMI readings were much more positive in Europe.

Sweden 62.5

Spain 54.5

Switzerland 57.4

Italy 56.2

France 55.1

Germany 58.2

Overall, 87% of countries reported growth.