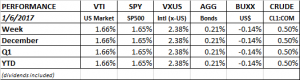

PERFORMANCE

The US equity markets rallied about 1.65%. International markets fared better, +2.38%. Bonds rallied by 0.21% as the yield curve moved slightly flatter. The dollar fell by 0.14% and oil was up by 0.50%.

The main focus was on the Dow as it made another push to break through 20,000. Of course, 20,000 is just a number and has no real economic meaning, but it serves as a milestone that makes news. And to traders, the number must have significance because they have been selling every time the Dow gets close. The Dow came within 0.37 of the mark on Friday, about as close as you can get without breaking through.

There is, however, a negative divergence between the technical indicators (see the pink declining trend lines towards the bottom of the chart below) and the higher prices of the Dow. This indicates a slowing of momentum and sometimes leads to a pullback.

EMPLOYMENT/PAYROLL

December payrolls increased by 156k. The unemployment rate increased by a tenth to 4.7% mainly due to an increase in labor force participation. Average hourly earnings reached a new cyclical high. Fed committee members will consider this as confirmation that the economy has reached full employment and that the Fed is on track for more interest rate increases. Expect further earnings increases due to the combination of a tight labor market and minimum wage increases in 20 states beginning in January.

TRADE WAR

We consider a trade war the greatest economic threat to this bull market. When Trump was first elected, the conventional wisdom was that he would concentrate on pro-growth policies like rolling back overbearing regulations, repatriation and corporate tax reform. It was also thought he would soft-pedal on trade, and avoid a dangerous trade war. That is what set off this market rally. But the closer we get to inauguration, the more Trump tweets, and the more he makes executive appointments, the greater the threat of a real trade war. Hopefully most of this is just posture for negotiation. And Trump has plenty of smart advisers that do understand the trade war threat, but this is something to watch closely.

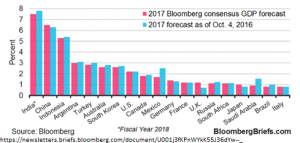

G-20 Growth Forecast

India is expected to lead the G20 with a forecast of 7.5% growth for 2017. China is estimated at 6.5%. Brazil and Italy make up the bottom slots at 0.80%.