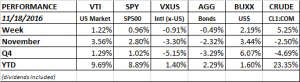

PERFORMANCE

The market picked up where it left off last week. Stocks advanced, bonds declined. Investors continue to concentrate on the positives and are laying off the negatives of what we know about Trump. Animal spirits are in the air. It has been value over growth, US centric over international and small over large. The financials and industrials have been the hot sectors. The surge in the dollar, up 3.44% for the month and now at its highest level since 2003, helps the smaller and more US focused companies. Sectors with a negative correlation to the yield curve like utilities, consumer staples and real estate are down.

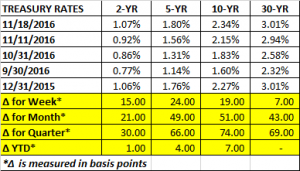

Bonds have taken a big hit due to the surge in interest rates. It has been the worst two-week stretch for the global fixed income market in 25 years. The 5 and 10-year notes are up by about 50 basis points this month. Taking a somewhat longer view, we are basically back to where we started the year. In fact, the 30-year is now yielding 3.01%, the same amount as at 12/31/2015. According to The Bespoke Report, the current decline in the US Aggregate Bond Index is the 7th worst since 1989. Of the nine other declines that make up the top 10, the aggregate posted a positive return over the next 12-months every single time with returns ranging from 4.22% to 13.32%. However, all those data points occurred during the 35-year bond bull market. That bull market might be over at this point.

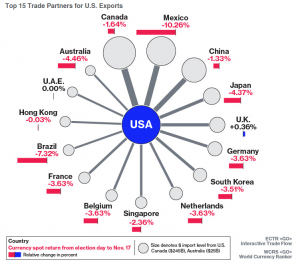

The rise in the dollar does have a darker side. Imports become cheaper, exports more expensive. That would hurt SP500 type companies that have a greater international focus, thereby explaining its recent underperformance. Trade flow, a focus for Trump, would now become even move uneven, ironically, because of the Trump rally. The chart below shows the change in currencies versus the dollar.

A higher dollar will also impact some emerging market economies that have debt primarily denominated in USD. The higher dollar makes it more expensive to repay that debt.

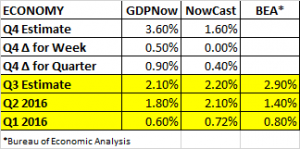

ECONOMICS

Inflation reports this week (PPI and CPI) came in at consensus or slightly weaker. So at least for this week, there weren’t any surprises to explain the surge in interest rates. Housing starts were strong, up 25.5%. Retail sales also were strong, up 4.3% year over year. Incredibly, jobless claims fell to 235k, the lowest level since 1973. It is hard to imagine that this number continues to be so low, but thankfully it has.

The Atlanta Fed’s GDPNow estimate for Q4 growth jumped by 1/2% to 3.6% for Q4 due to the positive residential construction report. The NY Fed’s Nowcast estimates Q4 growth at 2.4%, that is up 0.8% from the prior week. Retail sales along with housing starts helped improve the number. If these numbers hold the economy would see improved growth over each quarter this year.