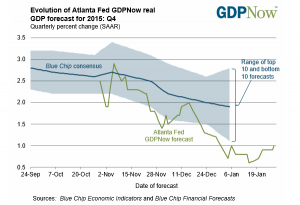

It was the worst start to a year ever, but a small rally towards the end of the month made January the seventh worst opening month start for the US equity markets. According to the Stock Trader’s Almanac, for five of the six other January’s that managed a worse return, gains were positive for the remainder of the year. Fear of spillover effects from China and the price of oil are leading to concern of a recession somewhere down the line. As of now, most economists do not see that happening and are looking to a period of more slow growth ahead. The latest numbers from the Atlanta Fed GDPNow forecast, a week by week estimate of GDP, released on Thursday, show Q4 closing out with a 1% gain. The US Bureau of Economic Analysis released its advanced estimate of Q4 GDP growth on Friday at +0.70%.

The market got off to a bad start during the first few days of January. There was a trifecta of negative Chinese data that clobbered the market and raised fears of China bringing down the rest of the world economy. The PMI reading out of China was less than 50. The Caixin Manufacturing PMI came in at 48.2, down from 48.6 the prior month but up from 47.2 in September. The currency, the Yuan, also depreciated by about 1.5% during the first week of January (see chart below). Volatilty spiked in the Chinese financial markets as equity price plunged, resulting in the use of newly installed “circuit breakers” that closed the exchanges. This led to even more selling. This combination was lethal and sent equities around the world plunging, the SPY dropped 5.84% by Friday, January 8.

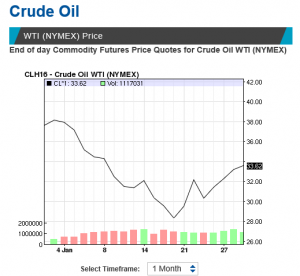

But the damage was not done. The other problem was the falling price of crude oil. Crude oil (West Texas Intermediate) dropped from about $38 per barrel to almost $28 (see chart below) on January 20. Current market prices are well below the marginal cost of production, and if prices don’t rebound there will likely be a wave of defaults in the high-yield fixed income sector. That could lead to negative consequences for the rest of the US economy. Crude began to rebound in the final 10 days of the month, closing January at $33.62. The SPY dropped to a closing low on January 20 of $185.65. That coincided with the low price in oil for the month and put the SPY at 8.94% off of the 2015 closing price at year-end and 12% off the recent high of November 3. On an intra-day basis, the SPY was off 14.21% on January 20th.

As crude oil began to rebound, the market slowly advanced. The market received some surprise news on the last trading of the month when Japan went to negative interest rates on excess reserves. The SPY advanced 2.44% on that. In total, since the January 20th close, the SPY has rallied 4.35%.

Fears that the Fed may move too aggressively and continue on their course of multiple rate increases were somewhat alleviated with their comments of January 27, we are “closely monitoring global economic and financial developments.”

For the entire month, the SPY declined by 4.98%, the overall US stock market as measured by the VTI dropped 5.72%, and international markets (x-US) fell 5.45% (VXUS). In a rush to safety, the aggregate bond index (AGG) moved up 1.24%.

Treasury rates fell. The 2-year dropped to 0.76% from 1.06%, the 5-year to 1.33% from 1.76%, the 10-year to 1.94% from 2.27% and the 30 year to 2.75% from 3.01%. High-yield increased, the Merrill Lynch US High Yield Option Adjusted Spread moved up to 7.75% from 6.95%.The High Yield Corporate Bond ETF (HYG) declined by 1.60%.

Materials (XLB) and financials (XLF) fell 10.71% and 8.85% respectively, while utilities (XLU) led the way with a 4.94% gain. The only other positive sector was consumer staples (XLK) which managed a gain of 0.67%.

The weight of the evidence seems to indicate that the US will avoid a recession, but further downside surprises from China or the price of oil could tip the scales.