The economy continues to advance, albeit slowly. The GDP came in for the first quarter basically flat, with a 0.1% advance. This was a big miss. GDP increased a strong 3.4% in the back half of 2013 so a drop to 0.1% is significant, but the weather was terrible in Q1 and did have a real impact although it is hard to blame all of the decline on the weather. But the economic reports coming in over the last few weeks have been generally positive and point to continued slow growth probably in the 2%+ range over the remainder of the year.

Employment reports have been good and the trend in initial claims has been declining of late. Continuing unemployment claims are down 5% from the end of March and down 10% from the end of February (this is based on the April 25 numbers). Jobs are still not being created in big numbers but they are being created. There is no news of huge layoffs in the system.

Regional activity for the most part is also up. The Chicago PMI was way up but the Milwaukee PMI was down. Reports from the Dallas Fed, Philadelphia Fed, Richmond Fed all were positive by nice amounts. The KC Fed report was down from the prior month. So in general the reports were leaning positive.

The home sale numbers released in April were the big disappointment. New home sales came in much lower than consensus (384k v 450k) and lower than last month (440k). But home prices continue to increase. The S&P/Case-Shiller 20-City Home Price Index increased year over year by 12.9% but this represents a smaller increase for the third consecutive month. Auto sales, released at the beginning of the month were good. Light vehicle sales were running at a 16.3m annual pace above the estimate of 15.84m.

While the economy is not booming it is not reversing either and there appears to be minimal stress in the system. The St. Louis Fed Financial Stress Index which is designed to measure stress in the financial system posted its largest weekly decline in 10 weeks today (report as of April 25 but released May 1) and is now at its lowest level since March 15, 2013.

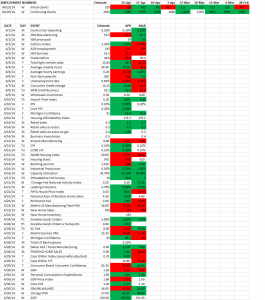

Below are the April numbers: