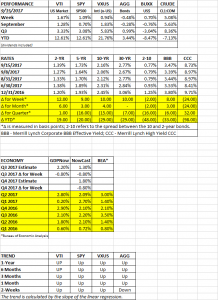

PERFORMANCE

The S&P 500 hit a new all-time high and in the process took another step forward in a continuation of the stair-step pattern we wrote about last week. The index was up 1.09% while the overall US market increased by 1.67%. International equities rose by 0.94%. Bonds were down by 0.48% as interest rates were up by 10 to 12 basis points across the curve. The dollar advanced by 0.70% and oil had a big rally, +5.08 percent.

WHEN ACTUAL INFLATION DEVIATES FROM EXPECTED INFLATION

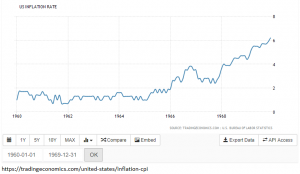

High valuations by some metrics in the equity markets have been justified by low-interest rates and low inflation. James Mackintosh writes in his Friday Wall Street Journal column that “what matters most to stock prices isn’t where inflation stands, but where it will stand in the future compared with what is currently priced in.” 1980 is an example, a period when inflation was ramping higher, before it was about to fall, as a good time to buy stocks.

Likewise, a bad time to invest in equities was when inflation is low and expectations for future inflation are also low, but then jumps higher. In the mid-60s, the economy was going on its seventh year of sub-2% inflation, at the same time, the Shiller P/E ratio was at its highest point since 1929. Once inflation broke above 2% at the beginning of 1966, the market fell by about 25%.

EQUITIES SPEND MOST OF THEIR TIME IN BULL MARKETS

There are lots of reasons why the market might go down, and we have outlined many of them at our webinars and in this column. But historically, staying in the market has always rewarded long-term investors. According to an analysis done by Bespoke, equities have spent about 88% of the time in a bull market since 1947.

ECONOMY

An early impact of hurricane Harvey was reflected in the August reading for US industrial production, it dropped by a seasonally adjusted 0.9%. That was the biggest fall since the 2007-2009 recession. The hurricane hurt oil drilling, petroleum refining, and other activity.

Initial jobless claims came in at 284,000 this week. That is down from 298,000 the prior week. But both of these numbers are big jumps from the 250,000 or so level that we had seen for many months. The increase is probably due to Hurricane Harvey. The impact of Irma will start being seen in the next few reports. The hurricanes will most likely hurt near-term economic performance before beginning to improve GDP in a few months as the recovery kicks in.

The Atlanta Fed’s GDPNow estimate for Q3 dropped by 0.8% to 2.20% on reports for retail sales, industrial production, and capacity utilization. The New York Fed’s Nowcast also fell by 0.80% to 1.3% The Q4 estimate is now at 1.80%.

SCOREBOARD