REVIEW

The market broke out to another high, continuing the stair-step pattern of consolidation, then another step higher. Fed Chair Janet Yellen testified before Congress and emphasized that rate hikes would be very deliberate and moderate. The market took that as good news and shot equities higher.

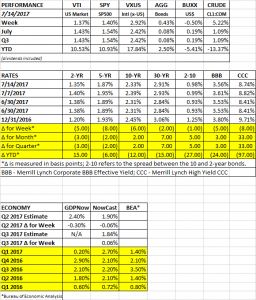

Bonds moved up by 0.43% as interest rates dropped on the testimony. The 10-year fell to 2.33% from 2.39%. Crude rallied by 5%.

Investors now view the probability of another interest rate hike this year as less likely. Yellen’s testimony, coupled with less than sanguine economic reports, makes it more likely that a September hike is off the table and lowers the probability of a December increase.

QUARTERLY WEBINAR

Our quarterly webinar was this weekend, click here.

SCOREBOARD