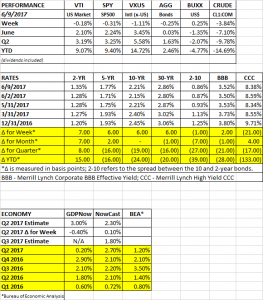

PERFORMANCE

US equity markets fell slightly, down 0.18% on the week, but what was of interest was the Friday price action within the market. There was, so to speak, a reshuffling of the deck. For no apparent reason, the tech leaders that have driven most of this price advance, fell hard. The QQQ, which is made up of the high-flying NASDAQ 100, dropped 2.50% on the day. AMZN was down 3.16%, AAPL -3.88%, FB -3.30%, NFLX -4.73% and GOOG -3.41%. But the money did not leave the US equity markets, the SP500 was only down 0.08%. Instead, it seems like the sales of the tech shares turned into buys of some of the more beaten down sectors. For example, banks were up 2.86% and (KBE), oil and gas increased by 3.75% (XOP). Last week we highlighted that growth stocks were outperforming value stocks to the point that the ratio between their two p/e’s was at a record level, the moves on Friday was a small step in reverting to the mean. International stocks were down 1.11%, bonds were down 0.25% as interest rates rose by about 6 basis points across the curve, the dollar increased and crude and had another tough week, falling by 3.84% to $45.83 per barrel.

EARNINGS

According to FactSet, guidance on earnings have been coming in at a more favorable ratio than in the past. So far, 75 companies have announced negative guidance, roughly in line with the 5-year average of 79. But 37 companies have announced positive guidance, higher than the 5-year average of 27. That puts the negative to positive guidance ratio at 2.02 versus 2.92. Most of the positive guidance has been coming from the information technology and the healthcare sectors.

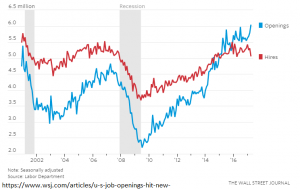

JOBS

According to the JOLTS survey, the number of job openings in April hit a record high of 6.044 million, indicating a jump in demand for labor. The report shows a skills mismatch between job openings and hires, as the gap has continued to widen.

Initial claims for unemployment declined by 10,000 to 245,000, close to a 30-year low. Eventually, the tight labor market should translate into more wage growth.

A JOBLESS RATE THIS LOW HAS HISTORICALLY ENDED BADLY

The unemployment rate dropped to 4.3% last week. That has only happened during three other periods. In all three cases, subsequent excesses in market behavior led to economic problems.

In the late 1960 low unemployment set the stage for the inflation of the 1970s which in turn led to the recession of the early 70s. In the late 1990s, low unemployment preceded the height of the dot-com era and the market fall in the early 2000s. After that, unemployment got this low in the mid-2000s, right when housing was beginning to heat up which led to the “great” recession.

One factor that differentiates today versus those prior periods, is that GDP is currently running subpar. In the previous periods, business was operating at 80%+ capacity. That is not the case today. Economists think there is slack in the economy which at least in theory should absorb some of the price bubbles of the past.

ECB Holds Steady

The European Central Bank kept rates steady, but indicated they probably wouldn’t cut interest rates again in this cycle. However, they also indicated they would be patient and would not cut back on their bond purchase program.

SCOREBOARD