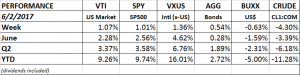

PERFORMANCE

Another week, another advance. The technology heavy Nasdaq composite was up 1.5% and the SP500 increased by about 1% to end the week at all-time highs. International stocks were uup 1.4%.

The payroll numbers this week were so so, but as interest rates continue to fall (see below), and coming off strong earnings reports, stocks continue to be the investment of choice.

Growth stocks have outperformed value stocks by about 11% year to date. The p/e on the S&P 500 Growth index now trades at 20x forward earnings, versus 15.4x on the value index. The ratio of the p/e of growth over value is now at 1.3, the highest level since 2013. Something that reversion to the mean fans might want to keep an eye on.

One cyclical industry that has been hit hard are the offshore oil drillers. Oil dropped by 4.3% on the week, supposedly because the US withdrawal from the Paris climate agreement would increase oil production. The IShares Oil and Equipment ETF (IEZ) is down 22% on the year.

EMPLOYMENT

The unemployment rate dropped to 4.3%, the lowest level in 16 years. Payrolls increased by 138,000, below consensus, and the two previous months payroll increases were revised down. However, the increase should be more than enough to absorb new entries in the work force. Economists estimate it takes about 100,000 more jobs per month to cover the new labor force entries. Initial unemployment claims rose by 13,000 to 248,000. That is the highest level in five weeks but it is still a historically low number.

Interest rates dropped in reaction to the job report. The 10-year treasury note fell to 2.15%, its lowest level since November.

The lower than consensus new hires report knocked down the GDPNow forecast for Q2 growth, falling to 3.4% from 4.0%.

MANUFACTURING ACTIVITY

The Institute for Supply Management reported that its index for manufacturing activity rose to 54.9 in May from 54.8 in April. Anything above 50 is considered expansionary.

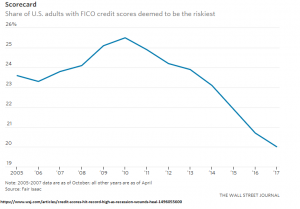

CREDIT PICTURE IMPROVES

The share of Americans with risky credit scores has hit a record low. At the same time, credit scores for consumers overall is at a record high, indicating that consumers are in good shape, are in a stronger position to borrow, and increasing the odds of a positive multiplier effect across the economy.