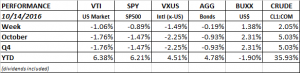

PERFORMANCE

Equity and fixed income markets were down on the week. US markets fell by about 1% and international markets by about 1.50%. Bonds declined by 0.19%, as the longer end of the curve got steeper.

Earnings season got off to a poor start on disappointing earnings by Alcoa. SP500 earnings have declined for five quarters in a row, and the expectation is for a small decline for Q3. However, normally earnings come in a little bit above expectations, so there is hope that the earnings slide might end.

A rising dollar (+1.38% for the week) also has not helped. That would cut into US exports and lower earnings from overseas, impacting US large-caps. The British pound fell by 2.17% as Brexit becomes closer to reality. A lot of the increase in the dollar was due to the fall of the Pound.

The political environment certainly has not done anything to help improve long term confidence in the US economy, unless one considers that Trump’s chances to win seem to have fallen. Not that the alternative is much better.

Technically, the market is starting to roll over from positive to negative. The chart below shows the price action of the US total stock market as measured by the VTI ETF. Prices are shown in white. The colored lines measure a linear regression for different lengths of time. When the regression line is moving higher, the trend is up for the given period. Likewise, when the regression line is moving down, so is the trend. For periods of 5-days (red), 21-days (yellow) and 63-days (green) the trend is down. For the two longer periods, 126-days (purple) and 252-days (blue), the trend is still up. This does not necessarily mean that the prices will continue down, but it is a different way to see that the market has lost its short-term positive momentum.

ECONOMY/GDP

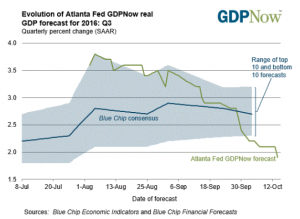

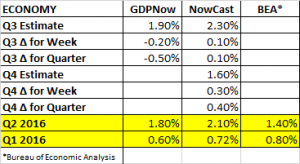

The Atlanta Fed’s GDP forecast for Q3 growth continued to fall. It has pretty much been one-way down since the original forecast in late July (see below). The estimate is now at 1.90%, which is down from 2.10% last week. The decline was impacted by a lower estimate of personal consumption expenditures.

The NY Fed’s Nowcast estimate for Q3 increased to 2.3% from 2.2% last week. The Q4 estimate increased to 1.6% from 1.3%. Higher than expected retail sales helped push the estimates higher.