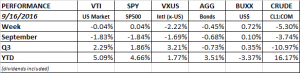

PERFORMANCE

US equity markets were about even on the week. International was down 2.22%, bonds were down 0.45%, the dollar was up 0.72% and crude took a big hit, down 5.30%.

The markets have been on an up and down ride recently. A week ago Friday, on fear of higher interest rates, the SPY (SP500 ETF) fell 2.4%. Another Fed official said on Monday that rates were probably not going anywhere in September, so the market rallied 1.44%, only to fall another 1.44% on Tuesday. Wednesday was down slightly, but on Thursday the market went up by almost 1%, and then fell on Friday to end the week just about even. For now, the SPY has found a floor in the 212.30 area. The Fed meets on Tuesday and Wednesday and you can be assured that will be closely watched.

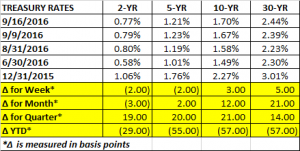

TREASURY RATES

For the month, treasury rates have been flat at the short-end but have increased by 12 basis points on the 10-year and 21 basis points on the 30-year, indicating a steeper yield curve. The same has been true around the world. Usually, a steepening curve is indicative of a growing economy, higher inflation or more aggressive central bank action. The market might be pricing in much higher deficits due to a large dose of fiscal stimulus under the new administration (no matter Trump or Clinton).

A steepening yield curve often will lead to lower returns for “bond proxies” like utilities and REITS and higher returns for banks. A few weeks is not a long-term trend, but it is something to watch.

GDP/ECONOMY

The Atlanta Fed’s GDPNow estimates Q3 growth at 3.0%. That is down from 3.3% last week. The drop was due to a decline in the estimate for real consumer spending growth and real government spending growth for Q3. The NY Fed NowCast remained unchanged at 2.8%.

Jobless claims continued at their remarkably low rate, coming in at 260k for the week. Retail sales fell 0.3% in August. It was the first decline in six months. Year over year retail sales are up 2.4%.

Core CPI was up 0.3%, the most in six months, driven by higher shelter and health care costs. Year over year, CPI was up 1.1% but that is up from 0.8% last month. Core CPI was up 2.3% year over year, the biggest increase since September of 2008.

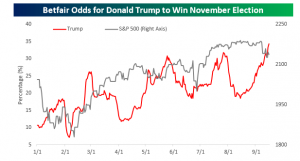

ODDS OF A TRUMP WIN

The odds continue to increase for a Trump win in November. As the odds increase, so does the level of economic uncertainty and markets do not like uncertainty. No matter your belief on if Trump will be good or bad, his proposed policies definitely increase the uncertainty level for the economy and that is probably being reflected in recent market volatility. The latest Betfair numbers put the odds of a Trump win at about 34%.