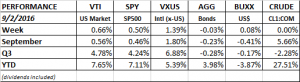

PERFORMANCE

Stocks moved up this week as a lower than expected payroll hiring number decreased the chance of a September rate hike. In the sometimes upside down world of stock market logic, that was considered good news. 150k jobs were added in August. The consensus was for 180k. Wages increased only by 0.1% and the average work week was slightly smaller.

GDP

The Atlanta Fed’s GDPNow Q3 forecast was up 0.1% for the week to 3.5% on a higher forecast from the contribution of net exports. The NY Fed’s Nowcast remained steady at 2.8%. Negative signals from a lower than expected ISM manufacturing report and lower than expected imports were offset by higher than expected consumer spending and exports. The ISM manufacturing index fell to 49.4. Below 50 is considered to be contractionary.

SALES TAX

Congress is working on a plan to fairly tax sales across state lines. Basically since the inception of the internet, most sales that have crossed state lines have effectively been tax exempt. This has had a devastating impact on local retailers, as they were put at a huge price disadvantage against internet retailers like Amazon. And this disadvantage has been going on for years at this point. While it has helped internet based businesses, it has unfairly hurt retailers that provide more local employment and that are a major source of small business formation. The proposal, while not ideal, is a step in the right direction and would tax according to the tax base of the retailer at a tax rate chosen by the consumer’s home state. So what does that mean in English? If a business in Ohio ships product X to Maryland, they would use Ohio’s rules for taxing item X and the tax rate that would apply would be from Maryland. The main objective should be to make it so that local business is not put at a disadvantage to internet based businesses.

OIL FIRMS

Oil prices may be up but they are still way down from a couple years back and the big oil firms are trying to adjust. They have been avoiding dividend cuts but time may not be on their side. BP, Shell, Exxon and Chevron could not cover their dividends in the first half of 2016 to the tune of $40 billion. They companies have been adding debt to help make up for the shortfall.

“WHO DID THIS TO US?”

We are a little off topic here, but Bret Stephens penned the above titled commentary in the Tuesday WSJ. Professor Bernard Lewis once wrote that when a nation is faced with adversity, there are two ways to respond. One, you can ask, “Who did this to us?” That question essentially leads to blaming all of your problems on others, to dig up conspiracy theories, and to avoid the real issues. And all of that leads to avoiding the real issues and further decline in the society.

Or, a society can ask this question, “What did we do wrong?” That leads to taking personal responsibility, understanding the real question and figuring out possible answers. Those societies have flourished and that has been the path that the United States has normally taken. But today, both political parties have been taking the route of blaming someone else for our “problems”. We really need to ask the correct question and work on real solutions.