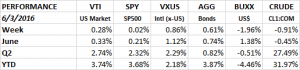

PERFORMANCE

The equity markets were flat to slightly up. The SP500 (SPY) was up 0.02%, the overall US market as measured by the VTI was up 0.28%, international markets advanced 0.86% and the aggregate bond index was up 0.61%. The US dollar declined by 1.96% and crude fell by 0.91%.

The SPY has held just above the declining trend line that it broke through last week. On Thursday the SPY closed at 210.91. That was the high for the year. The all-time closing high was 213.50 set on May 21, 2015. However, when adjusting for dividends, the Thursday close of 210.91 represents the all-time high. The May 21, 2015 adjusted close is 209.04 after dividends (per Yahoo Finance).

On each of the first three days of June, the market has started lower and worked its way up to close towards the high of the day. Some market-followers would consider that a bullish sign as supply could not overcome demand, even with the terrible payroll report (see further below).

PAYROLL

Non-farm payrolls rose only 38,000 in May. This was a huge miss. Estimates were for 100,000 plus. It was the lowest number in almost six years. Numbers were also revised downward for March and April. The number probably would have been about 35,000 higher without the Verizon strike but that is still much lower than expectations. The disappointing payroll number significantly lowered the chance of a Fed rate increase in June, given that one of the conditions to increase rates was continued improvement in the labor markets.

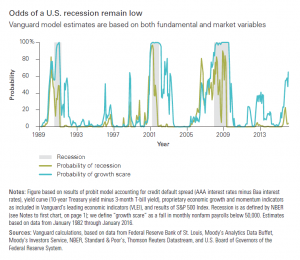

The Vanguard economic model, which we talked about at our April webinar, forecast a high likelihood of a “growth scare.” Vanguard defined that as a fall in monthly nonfarm payrolls below 50,000, exactly what happened. Writing on May 5, Vanguard economist Joel Davis said, “At this stage in our long economic expansion…slowing job growth is not a sign of recession. It’s a symptom of a labor market near full employment…our analysis of financial and economic variables puts the odds of a near-term recession at about 10%. So brace for bad headlines. Prepare to put the data in a broader – and less alarming – economic context. And fight the fear with patience and perspective.”

But economists at JP Morgan are placing a much higher probability of a US recession in the next 12 months. Putting the probability at 36% this week. That is the highest level during this economic recovery.

“Goods-producing” payrolls dropped by 38,000 in May. It was the fourth consecutive month that payrolls have fallen in this sector. According to David Rosenberg, chief strategist and economist at Gluskin Sheff, “this is precisely the sort of rundown we saw in November 1969, May 1974, October 1989, November 2000 and May 2007” that foreshadowed a recession by an average of five months.

The unemployment rate fell to 4.7% but that was due to about 500,000 people leaving the work force.

But even with the fall in new jobs, average hourly earnings was up 2.5%, year over year, indicating a tightening labor market.

On a more positive note, the initial jobless claims report came in at 267k, down 1k from last week. 267k is a historically low number.

GLOBAL RISK

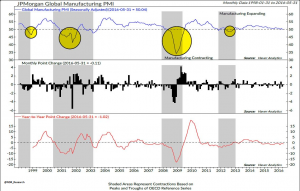

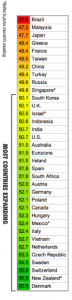

The probability of a global recession is also increasing and is much more likely than a US recession. We have been on recession watch outside the US for several months now. The global manufacturing PMI fell by about 0.1 to an even 50.04 in May, indicating flat manufacturing activity.

One bright spot, 71% of the reporting entities were in expansion mode, up from 60% last month.

OTHER ECONOMIC REPORTS

The ISM Non-Manufacturing Index fell to 52.9. Anything above 50 is considered as expansion, but 52.9 was the lowest number since September of 2013.

There were positive personal income and spending reports. Nominal incomes were up 4.91% year over year and spending rose 0.94% month over month. The savings rate is 5.3% indicating that US consumers are in decent shape.

Factory orders were also a positive. They rose 1.9% in April, the most in six months.

GDP ESTIMATES

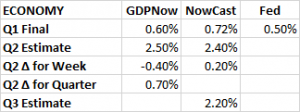

Even in the face of the non-farm payrolls report, the GDP estimates held in there. The Atlanta Fed’s GDPNow estimates Q2 growth at 2.50% (down from 2.90% last week). The NY Fed’s Nowcast forecasts Q2 growth at 2.40% (up from 2.20% last week).

SUMMARY

Economic news tilted negative this week but there were some positive reports. The non-farm payrolls report was such a huge miss it is hard to ignore. The global economy did take a step back and appears closer to a global (not US) recession. The equity markets held strong.