The market was down for the third week in a row. The US markets fell about 1/2% and the international markets were down almost 1%. The short-term momentum that has pushed the markets higher since February seems to be fading at this point. While the weekly trend has remained negative throughout this recent rally, the daily trend is now beginning to turn negative.

The SPY closed at 204.76, it has bounced off resistance of about 203.90 a couple of times already, so that line is likely to be tested again soon.

The US dollar increased for the second week in a row and that hurt the large caps. A higher US dollar makes our exports less competitive and hurts overseas earnings as they are translated back into dollars. Crude oil was up on the week 3.47%.

POLITICAL UNCERTAINTY

There has been a general consensus over the past week that the odds of a Trump Presidency have increased. Not to say that he is the odds on favorite, but sentiment has moved in his direction. Forgetting whether one believes that Trump will be great for the economy or terrible, there is no arguing that what policies he chooses to pursue and to what degree make his possible presidency much higher on the scale of uncertainty. And therein presents a problem for the markets and the economy. Uncertainty often means lower and/or volatile equity markets. Larry Summers went so far as to compare the US to an emerging market at the SALT Conference in Las Vegas, saying “political risk driving huge economic risk is something I always thought you talked about in connection with emerging markets. Now I think it is something you talk about in respect to the U.S.”

RETAIL

It was a tough week to be a retailer. Macy’s, JC Penny, Kohl’s and Nordstrom all had disappointing Q1 earnings and/or a disappointing outlook. Amazon is taking a bigger and bigger piece of the retail market and they seem to have really cut into the retailers over the past several months. According to the April retail sales report, online shopping was up 8.1% over the last four months.

In terms of the overall economy, the retail sales report did have good news, April retail sales were up 1.3% versus a 0.8% consensus. That was a big beat and was the main factor in pushing the GDPNow estimate for Q2 growth higher for the week.

GDP ESTIMATES

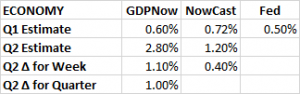

The retail sales report helped move the Atlanta Fed’s Q2 GDP estimate higher. GDPNow increased by 1.10% for the week to 2.80%. The NY Fed’s Nowcast also increased, but not by as much, to 1.20%. Both reports show improved growth over Q1.

EMPLOYMENT

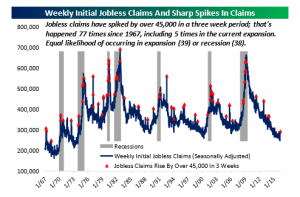

However, disappointing employment numbers would make one think that growth was declining, not increasing. Initial jobless claims came in much higher for the second week in a row. The number came in at 294k, up 20k from the prior week. It was the biggest gain in two years. We are closing in on the 300k level. The economy has held below that since March of 2015. Jobless claims are now up 46k since the low of 248k three weeks ago. Bespoke Investments ran an analysis showing that there have been 77 such spikes of 45k or more in initial jobless claims since 1967, including 5 in this current expansion. There is about a 50/50 split if an increase like this is indicative of a recession or continued expansion.

bespokepremium.com

bespokepremium.com

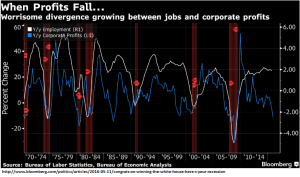

It might be that employment is going to start catching up with falling corporate profits. Profits have been down for more than a year now, but employment has held steady. At some point that divergence will most likely close. Either employment will fall or profits will improve.

On the other hand, the Job Openings and Labor Turnover Survey (JOLTS) report showed a 2.7% increase in the number of job openings in March to 5.757 million. Throughout this recovery, the job openings rate have been increasing faster than the hire rate, indicating mismatches between hiring needs and applicants able to fill those needs.

DIVIDEND CUTS

According to Standard and Poors, 213 companies have cut their dividends during the first four months of the year. That is the highest number since 2009 when 298 companies made cuts during the same time period. The energy sector was the main culprit.

SENTIMENT

The American Association of Individual Investors conducts a weekly survey of market sentiment. 20.4% of investors are bullish, that is the lowest reading since the week of February 11th when the market hit its low for the year. However, bearish sentiment is only 1% above the norm at 31%. In late January that number was above 40%. Most investors have now moved into the neutral camp.

EARNINGS

91% of SP500 companies have now reported. The blended earnings decline is 7.1% versus an expected decline of 8.8% on March 31 (per FactSet). The forward p/e is 16.60. The energy sector has reported a year-over-year earnings decline of 107.20%. Excluding the energy sectors, earnings would be down 1.80% for the SP500. Companies are still reporting that the high US dollar has negatively impacted earnings.

There is a belief out there among some that we have hit a trough in earnings and that they should begin to stabilize for a quarter or two and then begin to increase. Improved earnings would give the market reason to move higher.

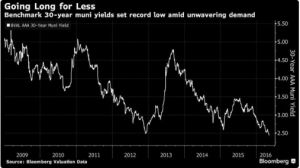

RISK IN BONDS

At some point interest rates will go up, and bonds will go down. Investor are clamoring for safety and whatever drop of yield they can find. That has pushed 30-year municipals down to an all-time low.

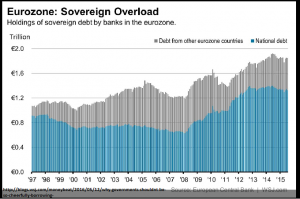

Along those same lines, governments, especially in Europe, have been borrowing long-term at ultra low interest rates. When interest rates begin to rise, even a little, holders of those bonds will face losses. Finance ministers may not view that as a problem, after all, it is the investors that will take the hit. But one of the problems is that the main investor in much of this debt are the same banks that these same governments have helped bail out. Higher interest rates in the future will hurt these same banks.

SUMMARY

Short-term market momentum and positive employment reports have been helping the equity markets and the economy since February, but both of those factors appear to be fading. It seems like the market is running out of fuel, turning down towards the end of the week after a promising start on Monday and Tuesday. The market is now down about 2.5% from its recent peak. Overall retail sales were a positive surprise, and that actually pushed GDP estimates for Q2 higher. Disappointing employment numbers are something to watch and are of concern. The economy cannot seem to get any serious positive traction. That coupled with the uninspiring choices for President have not helped.