MARKET RECAP

- US stocks -1.63%, international -2.03%, bonds -0.74%.

- Markets have been down for two straight weeks. Inflation continued to be higher than expected. Core services were up 5.4%. Consumer inflation expectations are rising, according to a University of Michigan survey.

- Investors expected six to seven rate cuts at the beginning of the year, but they are now down to one to two and maybe zero.

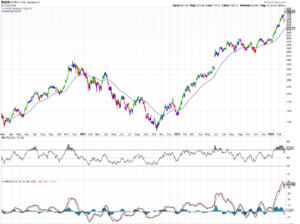

- The yield on the 10-year treasury is now 4.50% and is trending higher; see chart below.

- Bank stocks took a hit. JP Morgan has been on fire (in a good way) all year, fell by 6.5%, as high interest rates are beginning to cut into profits.

- The Philadelphia Fed reports that 3.5% of credit card balances are over 30 days past due, the highest delinquency rate since the data was recorded in 2012.

- International tensions are way up; investors were bracing for an Iranian attack on Israel, and it happened over the weekend. Israel did an exceptional job repelling the attacks.

CHART OF 10-YEAR TREASURY YIELD

SCOREBOARD